Next-Generation Performance Analysis and AIOps System for Digital Banking Resilience

PROBLEMS WE SOLVE

- Intelligent root-cause analysis across application, database, and network layers.

- Limited observability for branch, cloud, and payment systems.

- Compliance pressure to ensure high availability and data transparency (e.g. ISO 8583, PCI-DSS)

- Slow transaction response and high latency in digital banking systems

- Limited end-to-end observability to cover both application and network nodes

OUTCOMES

1

Mean Time to Resolution (MTTR) shortened from hours → minutes.

2

AI-Driven Intelligent Fault Analysis for Network and Application.

3

Gain reliable evidence for business system performance optimization.

4

Faults detecting in 1 minute, faults locating in 3 minutes, and faults recovering in 5 minutes.

USE CASES

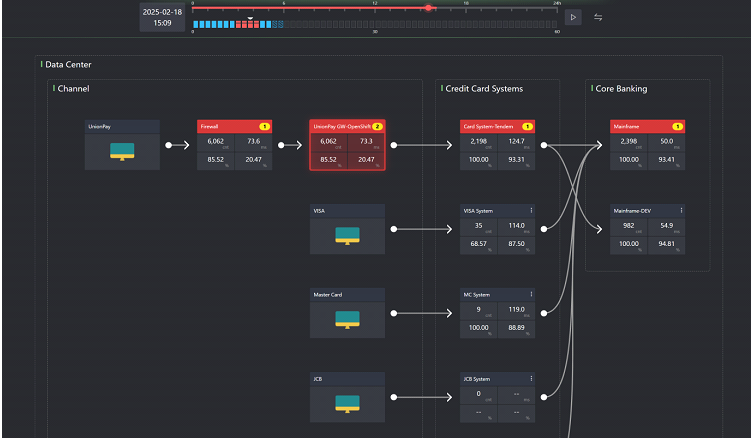

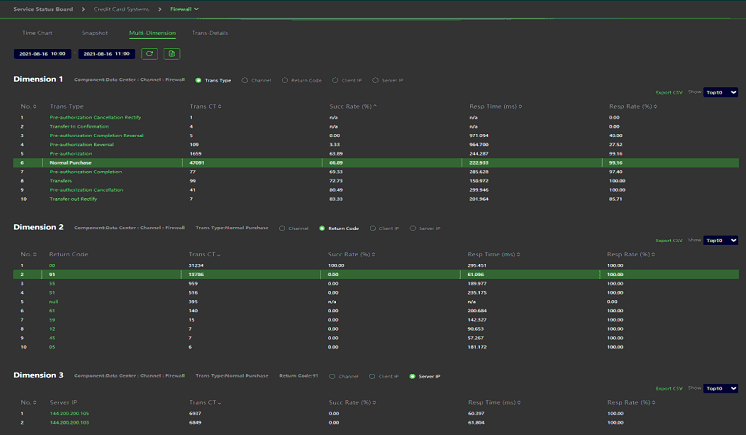

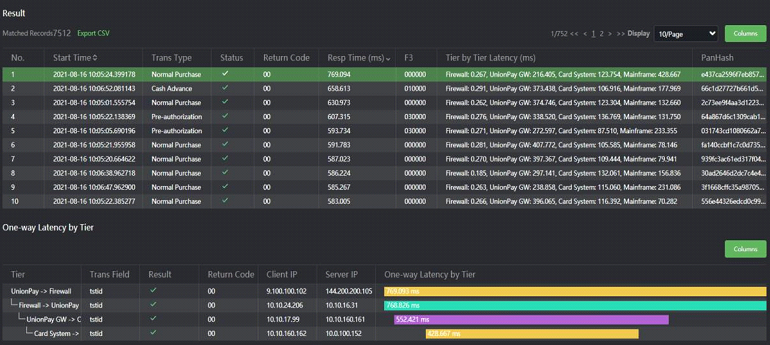

Digital Payment Platform Stability

Netis identified and visualized TCP retransmission and database locking delays causing payment slowness; RCA time dropped from 2 hours → 10 minutes.

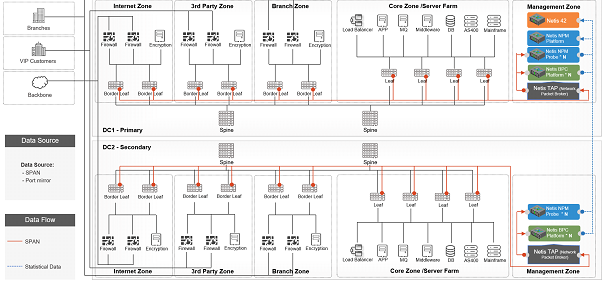

Core Banking Migration Monitoring

During core-system migration, Netis bypass probes ensured full visibility of inter-system traffic; detected SSL handshake anomalies before go-live.

ATM & Branch Connectivity:

Deployed Netis probes in DC aggregation points; localized WAN link congestion, improving transaction success rate by > 25%.

CORE CAPABILITIES

Full-stack traffic & transaction analysis (Network ↔ App ↔ DB)

AI-based Root Cause Analysis (RCA engine / xLLM diagnosis)

Real-time business KPIs & transaction correlation

On-premise ↔ Cloud / Overlay ↔ Underlay performance monitoring

Scenario-based alert and real-time analytics for anomaly detection

Restful API & data export to ITSM / SIEM / AIOps ecosystem

Mini architecture

🔹 Bypass Capture via TAP/SPAN

🔹 Network+Application+AI Diagnosis

🔹 Easy to be integrated

ASSETS (available now)