Real-Time Trading & Market-data Feeds Performance Observability

PROBLEMS WE SOLVE

- Lack of visibility into trading path delays across market-data feeds, FIX gateways, and routing infrastructure.

- Hard to diagnose intermittent order-execution slowdowns caused by ISP link instability or venue connectivity issues

- Difficulty correlating client session performance across co-location sites, brokers, exchanges, and internal systems.

- No unified evidence source to support audit, compliance, and post-trade investigations (T+0/T+1

- Microbursts, packet loss, and jitter on WAN/colo links degrading trading performance but invisible to legacy monitoring tools.

OUTCOMES

1

Detect market-data deterioration or feed gaps within seconds, enabling proactive mitigation.

2

Reduce root-cause analysis (RCA) time for trading incidents - from hours to minutes - with packet-level evidence.

3

Improve trading reliability and reduce timeout/failure ratios by identifying and correcting network or application anomalies. ]

USE CASES

Order-execution latency spike

What happened: Intermittent latency spikes affected FIX order flow. Netis correlated the delay with a accessing path change on the application architecture, revealing that the traffic was temporarily shifted to a longer-latency path.

Outcome: The issue was escalated to the application owner, the accessing path was restored, and order latency returned to baseline levels. RCA time dropped from hours to minutes, improving trading stability.

Market-data degradation

What happened: Traders observed delayed or inconsistent market-data feeds during active trading hours. Netis pinpointed microburst-induced packet loss and jitter on the exchange-facing link, identifying the exact time and location where feed quality degraded.

Outcome:The network team immediately mitigated the link issue, restoring real-time price delivery. Trading desks resumed normal operation, preventing potential missed opportunities and customer impact.

Regulatory audit / trade evidence

What happened: Compliance was required to produce precise evidence for a disputed trade. Netis extracted the full packet-level transaction stream – including timestamps, FIX message sequences, and network delivery timings.

Outcome: The organization delivered verifiable T+0 evidence that satisfied the regulator, avoided penalties, and simplified the investigation process.

CORE CAPABILITIES

Low-latency trading path monitoring

Market-data feed analytics

Transaction / FIX session observability

End-to-end trading system & network performance visibility

Packet-level and transaction-level evidence for compliance

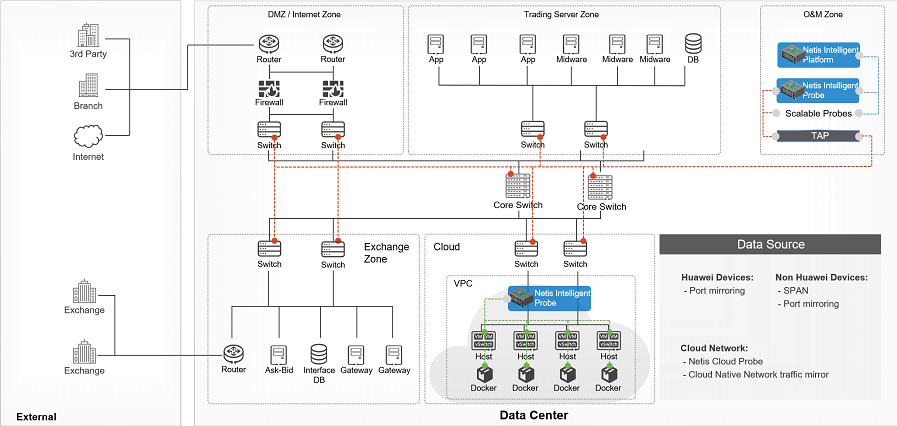

Mini architecture